Don't want the hassle of getting an SBR, but want the versatility? Check out our top picks for AR-15 pistols, the easy alternative to a short-barreled rifle. Firearm Review is here to give you a rundown on these guns.

Read More

Latest Reviews

USCCA Review [2023]: Benefits, Training, and More

I take a close look at USCCA, what it offers compared to the other guys, some numbers, and why I eventually chose it for my personal needs.

Read More

Best Featureless AR-15 Parts & Builds

Keep your AR-15 legal in the Golden State of California! Featureless AR-15s can still be functional and a great option for home defense and tactical training.

Read More

Best Complete AR-15 Uppers

Want to play with a new caliber or easily switch between barrels? These awesome complete AR-15 uppers let you do just that--without spending a ton. Firearm Review is running down the best complete AR-15 uppers here.

Read More

6 Best AR-15 Magazines: Standard & High Capacity

Reloading on the go? You should have multiple magazines on hand for your AR-15. Learn which polymer & metal mags perform best in terms of functionality and reliability!

Read More

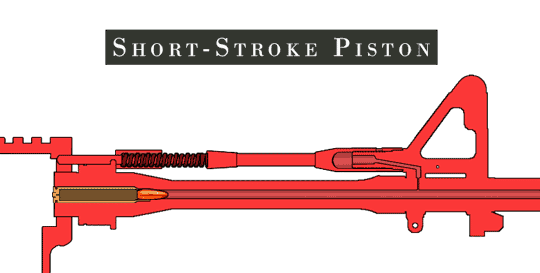

5 Best AR-15 Piston Uppers For Your AR-15 Build

Want to get the most out of your AR-15? Give a piston-driven upper a try! We'll walk you through the best picks for every budget and tell you just what you need to know to kick your rifle build up a notch.

Read More

5 Best 10mm Handguns & Pistols

10mm handguns and offer a little more oomph than your standard 9mm. But which models are the best? We break down which 10mm pistols we recommend for range day!

Read More